Measuring Stability and Security in Iraq

December 2007

Report to Congress

In accordance with the

Department of Defense Appropriations Act 2007

(Section 9010, Public Law 109-289)

Report to Congress

In accordance with the

Department of Defense Appropriations Act 2007

(Section 9010, Public Law 109-289)

Section 1-Stability and Security

1.2 Economic Activity

Several positive economic indicators emerged during this reporting period, most notably improvements in budget execution at both the ministerial and provincial levels, continued progress on the development of the 2008 budget and continued price stabilization. In addition, electrical generation, oil production and oil exports increased. Oil production expanded during this period to just under 2.3 million barrels per day and oil exports—which generate almost all of the government’s revenue—increased to over 1.8 million barrels per day at US$78 per barrel during October, significantly above the 2007 average. Through August 2007, initial reports indicate that capital budget execution is occurring at nearly double the rate it was in 2006. However, limits on capacity at both the ministerial and provincial levels will likely prevent the GoI from fully executing its capital budget. In addition, weak institutions, a poor business climate, limited access to capital, lack of essential services, poor technical skills and security issues remain obstacles to private sector-led growth. Amidst these problems, the GoI will have to accelerate its economic reform programs in order to build a strong private sector capable of attracting more foreign investment and supporting long-term self-sustaining economic growth and stability.

Budget Execution

To support continued economic growth and improve delivery of services, the GoI needs to make significant investment in its infrastructure with particular focus on the oil and electricity sectors. The GoI’s increased focus on budget execution has produced higher levels of actual capital spending this year than in 2006. The Ministry of Oil (MoO) is a good example. Although it spent only US$90 million or 3% of its US$3.5 billion capital budget in 2006, it reportedly spent US$727 million or 36% of its US$2.4 billion capital budget as of November 1, 2007. Overall, GoI ministries have executed 36% of their capital budgets as of November 1, 2007 compared with a third of that percentage as of the same date in 2006. The lack of capacity in contracting, the lack of trained budget personnel, concern about corruption and numerous other systemic structural impediments hamper faster execution. The U.S. Government is assisting with these problems through a variety of advisory efforts, including Procurement Assistance Centers, training activities, and capacity development programs.4 PRTs, the U.S. Agency for International Development (USAID) and the Department of the Treasury provide a more focused capacity building effort at the provincial level. Most provinces are now making significant progress in committing their 2007 capital budgets, having committed 64% as of early November 2007, and will increase significantly by the end of the year, as compared to 49% during all of 2006. Moreover, they spent 80%, or $1.5 billion, of their 2006 budgets this year, as they did not disburse any of their funding in 2006 even though they had committed as much as 50% of these funds to projects.

GoI efforts to develop the 2008 budget are ahead of the 2007 budget formulation process. However, minor political disagree-ments complicated timely passage of the 2008 budget bill, which had its second reading on December 5, 2007. Passage is likely to occur early next year after the CoR comes back in session. Should passage occur in January, the effect on budget execution should be minimal. This US$48.4 billion budget for 2008 includes US$9 billion for security and US$13.2 billion for capital investment, which are increases of 23% and 31%, respectively, over the 2007 budget. The GoI appears to be striking the right balance between security and capital investment.

IMF Stand-By Arrangement and Debt Relief

The International Monetary Fund (IMF) extended Iraq’s Stand-By Arrangement (SBA) to December 2007 during a review in August 2007. Iraq has negotiated a new IMF program for 2008, which the Board will consider on December 19, 2007. The GoI has remained in compliance with the SBA, and as a result, most members of the Paris Club except Russia have granted Iraq the first two tranches of relief totaling 60% of debt. Iraq must maintain continued satisfactory performance under an upper credit tranche IMF program to qualify for relief from the final 20% tranche of debt to reach the pledge total of 80% by the end of 2008, valued at $30 billion (excluding debt to Russia).

Some non-Paris Club creditors have also reduced their Iraqi debt and in a few cases eliminated it. Notably, in November 2007, Bulgaria announced that it had signed an agreement to provide Paris Club-comparable debt relief to Iraq. With a claim of US$3.5 billion, Bulgaria is the largest non-Paris Club creditor to conclude an agreement with Iraq. There has been little progress with Saudi Arabia and other Gulf countries, Iraq’s largest outstanding creditors. Debt negotiations between Iraq and Saudi Arabia broke down at the end of September 2007.

Indicators of Economic Activity

Economic Growth

The Iraqi economy is projected to grow 6.3% in 2007 with an estimated nominal gross domestic product (GDP) of US$60.9 billion. Much of the growth resulted from increases in the value of oil exports and growth in the services sector, mostly from government activities in areas such as security, education and healthcare. Agriculture and manufactur-ing continue to lag and will require signifi-cant investment, which in turn will require an improved security and investment climate.

Inflation

Year-on-year inflation as of October 2007 was 20.4% compared to 52.8% in October 2006 and 26.2% in October 2005. Year-to-date inflation as of October 2007 is 4.2%, compared to year-to-date inflation through October 2006 of 42.7% and 22.9% in 2005. Year-on-year core inflation (inflation excluding fuel and transportation) was 16.2% through October 2007, compared with 32% in October 2006 and 29.5% in October 2005. Year-to-date core inflation is 1.4% through October 2007, compared with 24.7% in October 2006. This overall reduction in inflation is largely due to the Central Bank of Iraq’s restrictive monetary policy, driven by continued appreciation of the Iraqi dinar from 1,475 dinars per U.S. dollar in late 2006 to 1,218 dinars per U.S. dollar currently.

Unemployment

Unemployment and underemployment remain major challenges. The Iraqi Government’s Central Statistical Organization official estimate of unemployment and underemploy-ment remains at 17.6% and 38.1%, respec-tively. Attempts to measure unemployment by other means at the provincial levels suggest that the rate could be much higher for some provinces. The key to resolving long-term employment issues in Iraq is private sector investment, but this requires a secure positive legal environment, access to capital and access to markets. U.S.-sponsored efforts have made some progress in providing better access to capital; however, progress is limited in the other two areas.

In October 2007, the Prime Minister approved a nationwide US$540 million small and medium loan program administered by the Ministry of Labor and Social Affairs and Ministry of Industry and Minerals to help reduce poverty, promote small business development, address high unemployment rates and stabilize the provinces. The Baghdad pilot program has granted over 4,600 subsidized bank loans valued at more than US$34 million and is estimated to have created 23,000 jobs. In addition, the U.S.-funded Izdihar loan program has granted over 16,000 loans nationwide averaging US$2,200 each for a total of more than US$38 million.

The USAID Community Stabilization Program has expanded into Diyala Province and has increased its capacity in Baghdad and Anbar Province. As of October 2007, the program has created 72,000 jobs since its inception. In addition, U.S.-funded projects executed by the U.S. Army Corps of Engineers employ an additional 34,000 Iraqis. As U.S. funding for these programs declines, these employment figures will drop if the programs are not transitioned to the GoI. The U.S. Government is engaging the GoI to fund transitional employment programs until the private sector has time to mature and offer alternative employment.

The U.S. Department of Defense (DoD) Task Force to Improve Business and Stability Operations-Iraq (TF-BSO) continues to assist with business and economic development in Iraq. To date, TF-BSO efforts have resulted in the restart of 17 factories and have restored sustained employment to over 5,000 Iraqis. Working with the Joint Contracting Command-Iraq/Afghanistan (JCC-I/A), the TF-BSO has developed and deployed contracting processes and systems that enable JCC-I/A to direct an average of over US$200 million per month in regional DoD spending to over 5,000 private Iraqi businesses. The Procurement Assistance Center (PAC) consults with Iraqi government employees to establish transparent and effective accounting, contracting and budget execution processes. The PAC is now guiding several high-profile, complex GoI procurements, including airliners, state-owned enterprise privatizations, educational facilities and pharmaceuticals, and is helping to create standard bidding documents for the MoO. The TF-BSO has also established a team dedicated to developing and expanding electronic financial and banking systems. This team works in close partnership with the Departments of State and Treasury and is assisting with the Iraqi transition from cash-based financial transactions to modern electronic financial transactions.

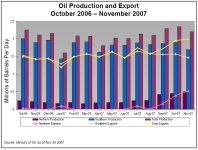

Oil Infrastructure Integrity

Crude oil production during September through November 2007 averaged 2.28 million barrels per day (mbbl/d) compared with 2.24 mbbl/d during the same period in 2006. During the month of November 2007, crude oil exports increased to 1.99 mbbl/d from about 1.57 mbbl/d in October 2006, slightly higher than the GoI’s goal of 1.7 mbbl/d. Numerous pipeline interdictions restricted crude exports through Turkey for the early part of this year. However, northern exports have been increasingly regular since late August 2007 due in part to increased security along the pipeline, more capable pipeline repair efforts and added redundancy in the pipeline system resulting from long-term construction and repair efforts. For example, the Kirkuk to Bayji crude and Iraq to Turkey export pipelines were operational for 70 days between August and October, compared to seven operational days during the same period in 2006. U.S.-funded infrastructure hardening projects and negotiations with tribal leaders are underway, which will secure the Bayji Oil Refinery, supporting infrastructure and crude oil pipeline exclusion zones.

Higher oil prices are expected to compensate for the temporarily plateaued production levels, resulting in actual government budget revenues exceeding planned revenue targets for the year. Corruption at all levels in the oil industry remains a significant problem. Iraq continues to suffer shortages of refined product because of scarce refining capacity, inadequate security for distribution pipelines and trucks, and under-funding of imports. The MoO has increased domestic production capacity and importation since August 2007, but supplies in northern and central Iraq remain low.

Essential Services

Improving the availability of basic services such as electricity, water and healthcare to all Iraqis could help improve the public’s confidence in the government. During this reporting period, the GoI’s improvements in budget execution have translated into minimal advances in the delivery of essential services to the people of Iraq, mainly due to sectarian bias in targeting and execution of remedial programs. With the U.S. Govern-ment’s 2004 Iraq Relief and Reconstruction fund limited to deobligated funds authorized for reobligation and with significantly reduced appropriations for other reconstruction funding sources in 2008, Iraq will now be required to fund most future reconstruction projects.

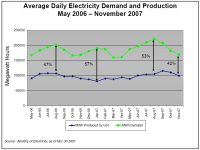

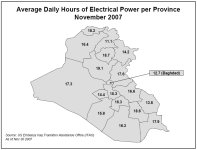

Electricity Infrastructure Integrity

State-provided electricity output for September through November 2007 averaged 107,581 megawatt hours (MWh), a 14% increase over production rates for the same period in 2006.5 Increased electricity delivery can be attributed to several factors, including the 15 new and six rehabilitated power generation units that have come on-line since September 15, 2007. If completed as scheduled over the next two years, these rehabilitation programs will add approxi-mately 3,300 megawatts (MW) of capacity. During this reporting period, about 900 MW became available; 2,400 MW are expected to come on-line in 2008. Fuel shortages and system maintenance, however, may reduce actual increases in electricity production. Average daily production of electricity decreased slightly in October and November due to planned generator maintenance; however, as demand for electricity decreased for the same period, the shortfall in electricity production has dropped to a total of 42% of total demand from 53% in August 2007. The postwar electricity production record for one day (123,000 MWh) was broken on October 12, 2007 with the production of 125,000 MWh. Despite these gains, supply consis-tently fell short of demand. Government produced electricity averaged 15.1 hours per day over the reporting period (September-November 2007) and 15.4 hours per day during November, the last full month for which data are available. The quarterly average exceeded the target goal of 12 hours of power per day nationwide. Baghdad, however, averaged only 11.5 hours of power per day this quarter and 12.7 hours per day during November, with some households receiving less than average amounts of power due to disparities in access among various neighborhoods. To assist in meeting demand, at least 2,000 MW are provided off-grid by private owners of small generators, leaving 20-30% or more of demand unfulfilled during peak periods.

During this quarter, a Chinese company, Shanghai Electric was awarded a US$750 million contract for the construction of one of the largest thermal power generation stations in Iraq, rated at 1,320 MW. The project is expected to take in excess of five years to construct the required supporting infrastruc-ture before the power plant can be brought on-line. Additionally, construction has been restarted on another power plant southwest of Baghdad at Yusufiyah after being abandoned in the late 1990s under the previous regime. If construction is completed on schedule, the plant’s 1,210 MW capacity should be online by 2010. SANIR Company, a subsidiary of Iran’s Energy Ministry, has been contracted to construct a small power plant and small refinery in Sadr City, a suburb of Baghdad. While the power station details are still unclear, this project was originally an Iranian initiative. Previously, the Ministry of Electricity (MoE) showed little interest in this project. Mean-while, Iran has offered to help provide electric power service and currently exports an average of 90-125 MW to Diyala Province.

Water and Sewer

As of November 2007, Iraq Relief and Reconstruction Fund (IRRF) - funded projects have added or restored 2.0 million cubic meters per day of potable water treatment capacity, sufficient to serve about 6.7 million Iraqis. The goal for U.S.-funded projects remains to add or restore 2.37 million cubic meters per day of treatment capacity to produce potable water, sufficient to serve 8.4 million Iraqis, provided that water delivery means such as pipes and pumps are also put into place.

Work continues on water sector projects. The Nassariya water supply project was com-pleted and turned over to the Ministry of Municipalities and Public Works (MMPW) on September 12, 2007. At the time of the turnover, the plant was operating at 20% capacity for one shift per day (about 6% of total capacity) due to lack of permanent power and insufficient numbers of trained operators. The U.S. Government will continue to provide technical guidance and training to MMPW personnel under the Water Sector Sustainment Program until December 2007 to ensure the personnel are capable of operating and maintaining the system on their own.

The Mosul Dam was built on an unstable rock foundation that is continuously dissolving, resulting in the formation of cavities and voids below the dam’s foundation that could cause catastrophic failure. In a worst-case scenario, significant flooding would begin to occur in Mosul within three hours; maximum water depth would be reached within eight hours and flooding along the Tigris could affect Baghdad 200 miles downstream within three days. However, there has been no assessment on the potential loss of life. The Ministry of Water and Resources (MoWR) has been pursuing a continuous grouting program since the dam’s completion in 1984.

The U.S. Government has expressed concern to the GoI regarding the safety of the Mosul Dam and the consequences of dam failure and has urged actions that could mitigate the risk. These include lowering normal reservoir levels; continuing dam grouting operations; developing a dam-break warning, evacuation, response and recovery plan; and developing more-permanent solutions. The GoI has reduced the reservoir levels and is in the process of implementing an enhanced grouting program. The U.S. Embassy has funded a project executed by the U.S. Army Corp of Engineers (USACE) to provide equipment, material and training to Iraqis for the enhanced grouting program but the actual grouting operations are the responsibility of the GoI6 The USACE has also strongly recommended that the GoI complete the Badush Dam, which is about ten miles downstream, as a vital safety backstop in the event of a Mosul Dam failure. Embassy advisors are working with the MoWR on the recommendations, but the responsibility for long-term solutions ultimately lies with the GoI, which is also obtaining alternative advice from other experts.

Healthcare

The United States completed construction of 85 of 142 planned Primary Healthcare Centers (PHCs), an increase of 16 since the last report. Thirty-nine of the 85 have been turned over to the Ministry of Health (MoH) and are currently open to the public. In Baghdad, 21 of 30 planned PHCs have been turned over to the MoH. Of these, 12 are open to the public with the remaining nine at various stages of construction. A number of PHCs have not opened to the public due to a shortage of trained medical staff and prob-lems within the MoH including a sectarian agenda that determined which PHCs would open. The PHC program is expected to be complete by May 2008 and the remaining IRRF-funded hospital rehabilitation projects are scheduled for completion by April 2008.

Food and Agriculture

An efficient and productive agricultural sector is critical to economic, political and social stability in Iraq. In Iraq, agriculture accounts for about 10% of GDP while providing jobs for about 25% of the population. The Iraqi National Markets and Agribusiness (INMA) program, a major USAID project launched in June 2007, is stimulating the growth and development of private agribusinesses in three major areas: tree crops including date palms, horticultural crops and livestock. Improvements and introductions of technology never before available in Iraq, new marketing systems and new linkages with producers will provide a flow of products to Iraqi consumers, as well as a foundation for sustainable agribusinesses and an expanded market for Iraqi farmers.

Seed treatment has begun for wheat, barley, and darnel while irrigation work continues for maize. Crops such as canola, sugar beets, lentils and winter vegetables are being seeded. Harvesting has begun for olives, sesame, cotton, and rice. Iraq is counting on the domestic rice harvest to add an additional 10% or more to Iraq’s overall rice supply. Revival of the cattle industry is moving forward. This will create jobs for Iraqis, increase the local production of milk and beef and provide milk protein to the PDS food basket.

Conclusion

Despite various challenges, the Iraqi economy continues to grow, and there are measurable signs of economic progress. Although oil production remains generally constant, the economy is benefiting from higher world prices and resumption of regular exports from the North. Electricity genera-tion peaked in October and production is

is expected to increase further in 2008. Ministerial and provincial budget execution is improving, and the 2008 budget process is on schedule. To capitalize on these gains the GoI will need to continue to make progress by implementing economic reforms to diversify the economy and sustain long-term growth.

|

NEWSLETTER

|

| Join the GlobalSecurity.org mailing list |

|

|

|