By around the year 2020 the state of the art of unmanned Autonomous Underwater Vehicles [AUV] was undergoing the sort of phase transition that had revolutionized Unmanned Air Vehicles two decades previously. Once UAVs came to be regarded as reusable aircraft rather than expedable munitions, there was a quantum leap in the size of the vehicles and the purposes to which they were put. Now such a revolutionary phase transition is underway underwater. In both cases, the foundation was the inexorable unfolding of the gift that keeps on giving, the miracle of Moore's Law. Computers onboard the vehicles could take on greater responsibility for more complex tasks, subject to human guidance. Unmanned Air Vehicles could receive commands and relay data [video, radar, etc] via broadband radiowave communications, to include direct satellite links. Autonomous Underwater Vehicles [AUV] can communicate for some considerable distances while submerged, via underwater accoutic communications. The challenge is the limited message size possible with this channel - text, of course, video, of course not. For Autonomous Underwater Vehicles, the secret ingredient was the advent of onboard computers that could act in response to human guidance provided by the rather meagre channel of underwater accoutic communications. At first, undewater vehicles required onboard human presence, but over time this guidance could be provided remotely via a cable tether. Now the tether has been severed, as the computers onboard the vehicle can execute complex tasks in response to simple directions. And it is no longer neccessary to have a cable connection to relay full motion video from the briny depths. Rather, processors onboard the vehicle can provide sonar target classification and location in brief text messages relayed through underwater accoutic communications channels [eg, "climb mount niitaka", or "scratch one flat-top"]. |

Unmanned Undersea Vehicles (UUV)

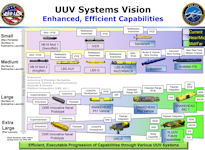

Unmanned Undersea Vehicles (UUVs), due to their limited endurance, require host platforms for launch and recovery. That reliance results in significant size restrictions limiting on-board power availability, precluding incorporation of redundancy for long-term operations, and reducing payload capacity. At the same time, new sensor and system payloads are rapidly being introduced that could expand the UUV mission set. Viable, costeffective UUVs providing endurance capabilities and meeting modular payload requirements for varied missions are needed to support the demonstration and refinement of capabilities in open ocean environments.

Unmanned Undersea Vehicles (UUVs), due to their limited endurance, require host platforms for launch and recovery. That reliance results in significant size restrictions limiting on-board power availability, precluding incorporation of redundancy for long-term operations, and reducing payload capacity. At the same time, new sensor and system payloads are rapidly being introduced that could expand the UUV mission set. Viable, costeffective UUVs providing endurance capabilities and meeting modular payload requirements for varied missions are needed to support the demonstration and refinement of capabilities in open ocean environments.

There are numerous missions where unmanned undersea systems can complement and extend the capabilities of manned systems. In particular, many operationally important missions that are not currently addressed due to lack of assets could be assigned to unmanned systems. A key to the success of this approach is the design and development of unmanned systems that are inexpensive enough to be acquired in large quantities. In fact, undersea is a domain in which the notion of quantity having a quality all its own resonates deeply. Large numbers of inexpensive systems can create challenges that cost adversaries more to counter than they cost the U.S. to produce, resulting in cost-imposing impacts in addition to expanded U.S. capabilities.

Historically, the U.S. Navy has had a tendency, in its requirements process in particular, to treat unmanned undersea systems like submarines. The systems are expected to have the ability to perform multiple complex missions and to have a high degree of stealth, endurance, and autonomy, all of which tend to drive up costs significantly. This may be due to the “innovator’s dilemma” that results from the Navy’s exquisite capabilities in submarine technology and operations, which drives a continual pursuit of more capable systems accompanied by a difficulty in recognizing the disruptive potential of less capable systems in limited mission environments.1 As a result, while many unmanned undersea vehicle (UUV) programs have been started, a significant number of them have been terminated due to cost growth, technological limitations, and schedule delays stemming from requirements creep (e.g., the Mission reconfigurable UUV and the Long-Term Mine Reconnaissance programs).

- Communications/autonomy – Relaxing the stealth constraint allows the system to surface periodically, which expands options for communications beyond acoustic channels to include broadband RF and optical channels. Intermittent broadband communications with the system will enable more robust human-to-system collaboration, and teaming with manned systems that will lower autonomy requirements, improve trust and confidence in the progress of the unmanned systems, and reduce costs.

- Energy storage – Reducing the stealth burden introduces an option to exploit mature diesel-electric propulsion to significantly expand the endurance of unmanned undersea systems. The added risk of discovery associated with periodic surfacing for snorkeling is acceptable when the system is unmanned because it will dramatically lower costs and make system loss more tolerable. Concepts that use at-sea replenishment can recharge batteries of low-cost commercial vehicles.

- Deployment and recovery – One of the major costs of an unmanned undersea system is the design and certification for carriage on manned platforms, particularly submarines. At-sea recovery of unmanned undersea systems by submarines is also a difficult technological challenge. Consequently, there was a need to explore concepts that use unmanned systems to deploy, tow, and carry systems to theater; that launch and recover the unmanned systems from different platforms; and that make the unmanned undersea systems expendable to eliminate the recovery problem altogether.

- Collaborative systems design approach – Designing unmanned undersea systems from the beginning to be part of a collaborative system that provides a capability can reduce costs by allowing specialization and eliminating redundancy. For example, a limited subset of vehicles in a large group can provide external navigation aids to the rest of the vehicles, eliminating the need for every vehicle to have a high-end navigation suite. Similarly, energy, data processing, and communications services can be concentrated in a few nodes that share the information with the rest of the group in order to greatly reduce the cost of the overall capability

During the past 20 years, there has been an increase in undersea activity, driven, in part by the oil, gas, and oceanographic communities, that has resulted in technological advances and the emergence of relatively inexpensive commercial undersea vehicles. There is an opportunity to leverage these commercial developments to create low-cost unmanned systems that offer significant new capabilities in combination with more focused and limited mission requirements. A promising approach for exploiting commercial systems, especially those with limited endurance, is to use new delivery concepts, such as prepositioning on the seabed or cascaded delivery. Cascaded delivery entails carrying smaller UUVs and unmanned undersea systems (UUSs) into an operational area by another larger system, such as a submarine, a surface ship (manned or unmanned), an airplane, or a larger UUV. In many cases, the carried systems can be readily available commercial technologies adapted to the mission requirements.

These craft will be fully autonomous, without a “human in the loop,” and they will not have any cables or tethers to provide remote control, navigation, or “power down the wire” from a host ship or platform. These new unmanned undersea systems will complement submarines by operating in collaboration with them and, in selected missions, performing more tasks than submarines. In those missions where the unmanned undersea system must be more autonomous, manned supervision through undersea communication or by surfacing periodically to close an airborne communication link (radio frequency (RF) or optical) with a remote human supervisor will still be possible.

Unmanned undersea vehicles (UUVs) will transform the Navy’s future operations by extending the area and volume that can be sensed, influenced, and affected through power projection. The proliferation of UUVs in quantity throughout the force structure will significantly amplify capacity and enable these vehicles to inherit missions that currently are too dangerous or beyond the capability of manned platforms. UUVs can investigate vast areas of ocean or conduct surveillance of remote undersea locations that are too shallow, difficult, or hostile for traditional platforms to investigate.

According to Astute Analytica, a global analytics and advisory company, the global unmanned underwater vehicles market is projected to reach a valuation of US$ 24.28 billion by 2032, up from US$ 4.24 billion in 2023, at a CAGR of 21.40% during the forecast period 2024–2032. The Unmanned Underwater Vehicles (UUVs) market is experiencing significant growth driven by rapid technological advancements. These advancements have expanded the capabilities and potential applications for UUVs across industries. In line with this, they are increasingly being equipped with sophisticated sensors and instruments for collecting crucial data on bathymetry, water quality, and seafloor conditions. Apart from this, they often come equipped with navigation and control systems like inertial navigation, GPS, and sonar to ensure precise underwater movement. For seamless communication, most of the manufacturers are offering UUVs enabled with wireless communication systems and robust storage solutions enable real-time data transmission and storage. Astute Analytica’s study revels that most of these vehicles are fitted with lithium-ion batteries for long range, but fuel cell option is being explored to extent this range further.

It has been observed that most of the manufacturers and end users around the world are targeting lightweight and durable materials such as carbon fiber composites are transforming UUV design. Additionally, the integration of AI is leading to enhanced autonomous capabilities and intelligent decision-making. Therefore, making UUVs increasingly valuable assets in diverse sectors. These advancements are fueling market growth as UUVs become essential tools for defense, scientific research, and environmental monitoring.

The defense sector is a major adopter of UUVs and contributes over 39% revenue to global unmanned underwater vehicles market, primarily utilizing them for intelligence gathering, mine countermeasures, and surveillance operations. Moreover, UUVs are revolutionizing deep-sea exploration and oceanographic studies in scientific research activities. Wherein, the environmental sector heavily relies on UUVs to monitor and protect underwater ecosystems, understand the status of marine pollution, and track climate change impacts.

Over the last few years, demand for AUVs or automated underwater vehicles have been booming in the unmanned underwater vehicles market. Improvements in many aspects, like autonomy and sensors, and also subsea residency has given a significant push to these products. Some of these vehicles have even gone on to make headlines for their exceptional performance. Houston Mechatronics' Aquanaut is one of them boasting a 200km range and 24-hour endurance run time just gives an idea of how much work developers are putting into making better operational capabilities. Recently, the market has also seen another big effort from participants to show their dedication to innovation and sustainability. Ocean Power Technologies, Modus, and Saab Seaeye have teamed up together to develop carbon-free AUV residency solutions which will be a great help in protecting the environment.

AUVs are changing how we do things underwater in various industries with each advancement they take on but not without reason too as they continue to break barriers through multiple avenues such as autonomy and endurance that were unheard of before Kongsberg Maritime's HUGIN Endurance. The use of advanced sensors aided by AI technology similar to how Saipem's FlatFish AUV uses, it allows for more complex inspection work all while collecting more data compared traditional methods in the unmanned underwater vehicles market. These continuous improvements prove that AUVs are quickly developing new skills that make them valuable assets in oil & gas, marine research, and defense operations.

In order for the industry to move forward at a faster pace, developers have started focusing on two areas: Ease of use for customers and operational efficiency. For instance, Seaber’s YUCO Micro AUVs has provided intuitive web-based interfaces for easier control over their product. While Teledyne Gavia has focused on providing a modular design with its SeaRaptor vehicle that aims at offering flexibility during different missions and payloads sessions helping us complete tasks quicker than ever before.

From the past few years, unmanned underwater vehicles market have been able to capture a lot of attention from the defense sector for their strategic value on the battlefield. Wherein, it can be dangerous for humans to navigate under the sea, which is where UUVs come into play. Apart from this, they are becoming a must have for many military operations including intelligences gathering, mine countermeasures, and strengthening underwater defense. In short, the UUAs give technology gives armed forces the ability to excel in underwater surveillance, reconnaissance and warfare.

UUVs equipped with specialized Anti-Submarine Warfare (ASW) sensors provide rapid and persistent surveillance, making them very valuable in this rapidly changing maritime warfare. Situational awareness is everything in modern warfare where enemies are finding new ways to stay hidden from radar. The U.S. Navy specifically has put a great deal of resources into AUV technology with investments in surveillance, mine countermeasures and reconnaissance missions.Astute Analytica is a global analytics and advisory company

|

NEWSLETTER

|

| Join the GlobalSecurity.org mailing list |

|

|

|