Special Districts

A special district is an independent unit of local government organized to perform a single governmental function or a restricted number of related functions. Special districts usually have the power to incur debt and levy taxes; however, certain types of special districts are entirely dependent upon enterprise earnings and cannot impose taxes. Examples of special districts are water and flood control districts, and transit authorities, port authorities, and electric power authorities.

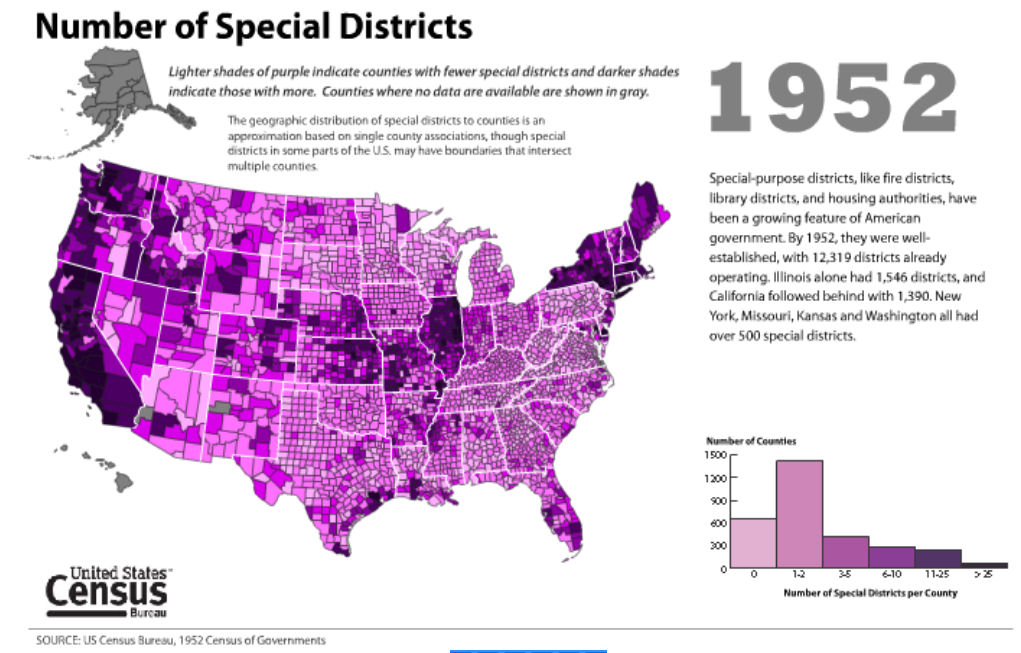

There were 38,266 special district governments enumerated in 2012. Special district governments are independent, special purpose governmental units that exist as separate entities with substantial administrative and fiscal independence from general purpose local governments. As defined for Census Bureau statistics on governments, the term “special district governments” excludes school district governments as they are defined as a separate governmental type.

Special district governments provide specific services. Most perform a single function, but in some instances, their enabling legislation allows them to provide several, usually related, types of services. The services provided by these districts range from such basic social needs, such as hospitals and fire protection, to the less conspicuous tasks of mosquito abatement and upkeep of cemeteries.

The Census Bureau classification of special district governments covers a wide variety of entities, most of which are officially called districts or authorities. Not all public agencies so termed, however, represent separate govern¬ments. Many entities that carry the designation “district” or “authority” are, by law, so closely related to county, municipal, town or township, or state governments that they are classified as subordinate agencies of those governments in Census Bureau statistics on governments.

Oregaon law [ORS 198.010 and 198.335] authorize 28 types of districts: water control, irrigation, ports, regional air quality control authorities, fire, hospital, mass transit, sanitary districts and authorities, people’s utility, domestic water supply districts and authorities, cemetery, park and recreation, metropolitan service, special road, road assessment, highway lighting, health, vector control, water improvement, weather modification, geothermal heating, transportation, county service, chemical control, weed control, emergency communications, diking, and soil and water conservation districts. These Special Districts are financed through property taxes, fees for services, or a combination thereof. Most special districts are directed by a governing body elected by the voters.

With over 6800 independent governmental units in operation, Illinois has the distinction of having more local governments than any other state. According to the latest information available from the U.S. Census Bureau, Illinois has 102 counties, 1,433 townships, 1,288 municipalities, 944 school districts, and 3,068 independent special districts. While the Illinois Constitution establishes the basic framework for local governments, the actual authorization for establishment and organization of such units is provided in the Illinois Compiled Statutes.

Special Districts differ from general-purpose governments such as counties and municipalities in that they provide a single service or group of services. The functions they undertake range from basic services such as fire protection and water supply to more quality-of-life enhancing services like historic preservation and mosquito abatement.

The delegates of the 1970 Illinois Constitutional Convention sought to put the brakes on the increase in the number of special districts by lifting tax limitations on certain municipalities and counties through home rule powers and by promoting intergovernmental cooperation. They reasoned that tax limitations prevented municipalities, and in some cases counties, from providing services the public wanted, thus giving rise to the creation of special districts. Moreover, they believed intergovernmental cooperation would ultimately save money. In spite of the home rule powers granted to larger municipalities and Cook County, and the Intergovernmental Cooperation powers contained in the Constitution later reinforced by law, the proliferation continued.

Since Illinois has more local governments than any other state, itís hardly surprising that it also has more special districts, although it is difficult to fix the precise number. Not only do the numbers change each year, there is no standardized method of keeping track of the total. Two agencies tally special districts in Illinois, the Department of Revenue and the Office of the Comptroller, but each uses a different methodology because they use the data for different purposes. The Department of Revenue counts only taxing districts, which numbered 2,926 for FY 2001. The Office of Comptroller counts special districts that file annual reports or audits, which came to 4,689 in FY 2001. The U.S. Census Bureau reported 3,068 special districts in Illinois in 1997.

Illinois has the largest number of special districts with 3,068. California comes closest to matching Illinois with 3,010, but the state contains more territory and has a larger population than Illinois. Texas, with 2182, ranks a distant third according to Census Bureau, and is the only other state with more than 2,000 special districts. Indiana (1,236) and Missouri (1,497) are roughly comparable Midwestern states, yet neither have half of the total special districts in Illinois. In fact Cook County, with 244 special districts, according to the Census Bureau, has more special districts than 10 individual U.S. states, or the combined total of special districts in Alaska, Louisiana, Vermont, and Rhode Island.

|

NEWSLETTER

|

| Join the GlobalSecurity.org mailing list |

|

|

|