Starship / Big Falcon Rocket

SpaceX launched and successfully landed its futuristic SN15 Starship on 05 May 2021, finally succeeding with a test flight of the rocketship that Elon Musk intends to use to land astronauts on the moon and send people to Mars. SpaceX’s Starship spacecraft and Super Heavy rocket (collectively referred to as Starship) represent a fully reusable transportation system designed to carry both crew and cargo to Earth orbit, the Moon, Mars and beyond. Starship will be the world’s most powerful launch vehicle ever developed, with the ability to carry in excess of 100 metric tonnes to Earth orbit. All four earlier attempts to land the rocket designed for travel to the moon and Mars ended in spectacular crashes.

SpaceX launched and successfully landed its futuristic SN15 Starship on 05 May 2021, finally succeeding with a test flight of the rocketship that Elon Musk intends to use to land astronauts on the moon and send people to Mars. SpaceX’s Starship spacecraft and Super Heavy rocket (collectively referred to as Starship) represent a fully reusable transportation system designed to carry both crew and cargo to Earth orbit, the Moon, Mars and beyond. Starship will be the world’s most powerful launch vehicle ever developed, with the ability to carry in excess of 100 metric tonnes to Earth orbit. All four earlier attempts to land the rocket designed for travel to the moon and Mars ended in spectacular crashes.

The original design for SpaceX’s Starship has gone through several changes over the years as engineers work to make it a reality. Fashioned out of stainless steel, the craft resembles a retro-looking spaceship you would have seen in 1950s science fiction. Ever optimistic, Musk continues to state that the rocket could be carrying people to Mars by the mid-2020s. Japanese billionaire Yusaku Maezawa was the first to back Starship, booking a flight around the moon. That mission is slated to blast off in 2023 if all goes as planned.

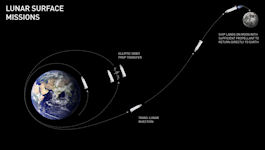

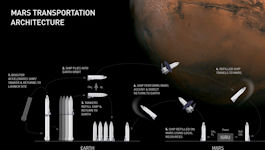

On September 29th, 2017, SpaceX CEO and Lead Designer Elon Musk presented an updated vehicle design for what was initially referred to as BFR, but later changed to Starship. A key challenge with the original vehicle design was figuring out how to pay for it. The updated design solves this problem by leveraging a slightly smaller vehicle that can service all greater Earth orbit needs as well as the Moon and Mars. This single system — one booster and one ship — will eventually replace Falcon 9, Falcon Heavy and Dragon. By creating a single system that can service a variety of markets, SpaceX can redirect resources from Falcon 9, Falcon Heavy and Dragon to the BFR system—which is fundamental in making BFR affordable.

The aspirational goal is to send the first cargo mission to Mars in 2022. The objectives for the first mission will be to confirm water resources and identify hazards along with putting in place initial power, mining, and life support infrastructure. A second mission, with both cargo and crew, is targeted for 2024, with primary objectives of building a propellant depot and preparing for future crew flights. The ships from these initial missions will also serve as the beginnings of our first Mars base, from which a thriving city and eventually a self-sustaining civilization on Mars can be built.

BFR will enter the Mars atmosphere at 7.5 kilometers per second and decelerate aerodynamically. The vehicle’s heat shield is designed to withstand multiple entries, but given that the vehicle is coming into the Mars atmosphere so hot, designers still expect to see some ablation of the heat shield (similar to wear and tear on a brake pad).

An important question we have to answer is “how do we pay for this system?” The answer lies in creating a single system that can support a variety of mission types. In turn, SpaceX can redirect resources from Falcon 9, Falcon Heavy and Dragon to this system.

With BFR, most of what people consider to be long distance trips would be completed in less than half an hour. In addition to vastly increased speed, one great thing about traveling in space is there is almost no friction. Once the ship leaves the atmosphere, there is no turbulence or weather. Consider how much time people currently spend traveling from one place to another. Now imagine most journeys taking less than 30 minutes, with access to anywhere in the world in an hour or less.

In September 2018, SpaceX said Japanese billionaire Yusaku Maezawa, founder and chief executive of online fashion retailer Zozo, would be the company’s first passenger on a voyage around the moon on its forthcoming Big Falcon Rocket spaceship, tentatively scheduled for 2023. Musk, the billionaire CEO of electric carmaker Tesla, said the Big Falcon Rocket could conduct its first orbital flights in two to three years as part of his grand plan to shuttle passengers to the moon and eventually fly humans and cargo to Mars.

Standing nearly 400 feet tall, the Super Heavy/Starship vehicle eventually will replace SpaceX's entire fleet of Falcon 9 and Falcon Heavy rockets, Musk said, along with the Crew Dragon spacecraft the company is building to carry astronauts to and from the International Space Station. Along with the Mark 1 Starship in Boca Chica, SpaceX also is building another ship — the Mark 2 — at an industrial park near the Kennedy Space Center in Florida — along with a launch stand at the NASA spaceport. A Mark 3 version will be built at Boca Chica.

Musk’s vision is to eventually build one Starship a week. "I think we need, probably, on the order of 1,000 ships," he says. SpaceX eventually wants to launch an average of three Starship rockets a day, each carrying a 100-ton payload. A 1,000 Starship fleet would be capable of taking nearly 100,000 people to Mars everytime their planetary orbits sync, or every 26 months.

It all adds up to the golden number Musk keeps referring to. One million people. That’s how many people he believes need to live on Mars for the population to become sustainable, and distinct from earth. More specifically, that’s how many people he estimates are needed to recreate Earth’s entire industrial base, so that they can build, manufacture or process anything without relying on earth.

At the heart of it all, Musk is driven by the need to ensure humanity becomes a multi-planetary species, which he believes is essential to our survival. “If something goes wrong with planet Earth, he pontificates, “that’s it. It’s game over.”

Starhopper

Starship, minus dragon wings, initially existed in a prototype "hopper" form for testing purposes. The next-generation space vehicle is meant to eventually reach Earth orbit and beyond, including the moon and Mars. Starhopper was undergoing tests with a single Raptor engine attached underneath it at SpaceX's facility in Boca Chica, Texas. The hopper first fired up on 03 April 2019. The tethered prototype isn't meant to reach space. Musk's declaration that Starhopper hit the end of its tether indicates the second hop was likely higher than the first.

SpaceX’s massive new spacecraft successfully test-fired its rocket engine for the first time 17 April 2019. The “hopper” version of the Starship rocket — dubbed Starhopper — did not leave the ground, but its powerful Raptor engine fired briefly while tethered to the ground at the SpaceX facility in south Texas. “Starhopper completed tethered hop. All systems green,” SpaceX Chief Executive Elon Musk tweeted. Starship itself should end up sporting seven Raptor engines, but it's also meant to be paired with a SpaceX Super Heavy rocket, which could use up to 31.

SpaceX wanted to build and fly to orbit with the full orbital version of the Super Heavy Starship in 2020. This would be with seven raptor engines for the new top stage of a full two vehicle.

SpaceX’s first partially-assembled Starship vehicle exploded during a cryogenic loading test Spaceflight reported. “The purpose of today’s test was to pressurize systems to the max, so the outcome was not completely unexpected,” SpaceX said in a statement. “There were no injuries, nor is this a serious setback.” The explosion blasted what appeared to be an upper bulkhead high into the air above the company’s seaside Boca Chica, Texas launch complex — about 20 miles east of Brownsville.

"This thing is going to take off," he said of the Mark 1, "fly to 65,000 feet, about 20 kilometers, and come back and land in about one to two months. So that giant thing, it's going to be pretty epic to see that thing take off and come back. ... It's wild." The SpaceX statement, however, said a decision was made before Wednesday's test not to fly the Mark 1 "test article" and instead to press ahead with another, more sophisticated prototype designed to reach orbit.

The vehicle was first presented in Texas on September 29. Head of SpaceX Elon Musk said the spacecraft with the ability to carry in excess of 100 metric tons to Earth orbit would make its first flight in the upcoming six months. paceX's Starship spacecraft and Super Heavy rocket (collectively referred to as Starship) represent a fully reusable transportation system designed to carry both crew and cargo to Earth orbit, the Moon, Mars and beyond. Starship. Drawing on an extensive history of launch vehicle and engine development programs, SpaceX has been rapidly iterating on the design of Starship with orbital-flight targeted for 2020.

Starship serial number 8 (SN8) lifted off from our Cameron County launch pad and successfully ascended, transitioned propellant, and performed its landing flip maneuver with precise flap control to reach its landing point. Low pressure in the fuel header tank during the landing burn led to high touchdown velocity resulting in a hard (and exciting!) landing.

On 09 December 2020, two days after SpaceX’s starship launch was cancelled a mere 1.3 seconds before lift-off, the giant gleaming steel rocket exploded on landing after reaching an altitude of 12.5 km, performing a flip and returning back to its launch pad. A week earlier, SpaceX’s founder Elon Musk gave the test flight 2 in 3 chances of failure. In a bout of excitement, he tweeted out, “Mars, here we come!!” But even before the failure of its largest prototype spaceship, SpaceX was already busy working on two newer prototypes. SpaceX knew many things could go wrong with Starship. After all, the first two Starships blew up.

The current (eighth) Starship prototype the company tried to launch is 16 stories tall. What’s more, it’s not even complete. It will require another 23-storey booster rocket to lift it into orbit while preserving its fuel, before yet another rocket refuels it in space.

Background

According to data compiled by The Times, Tesla Motors Inc., SolarCity Corp and Space Exploration Technologies Corp. (SpaceX) have together received an estimated $4.9 billion in government support. The numbers shed light on an emerging theme running through Musk’s business empire: a public-private financing model to manage the risk of launching long-shot start-ups.

As Dan Dolev, an analyst at Jefferies Equity Research, said: “He definitely goes where there is government money. That’s a great strategy, but the government will cut you off one day.” Tesla and SolarCity continue to report net losses after a decade in business, yet the stock in both companies has continued to grow. Musk owns 27% of Tesla and 23% of SolarCity. Musk’s stake in the firms alone is worth about $10 billion. “Government support is a theme of all three of these companies, and without it none of them would be around,” said Mark Spiegel, a hedge fund manager for Stanphyl Capital Partners who is shorting Tesla’s stock (a bet that pays off if Tesla shares fail).

In a 2008 blog post, Musk shared his plan that after the sports car, Tesla would produce a sedan costing “half the $89k price point of the Tesla Roadster and the third model will be even more affordable.” Yet by 2017 the second model sold for around $100,000 and timing on a less expensive model was uncertain.

The activities of SpaceX are abundantly subsidized and subsidized from the state budget of the United States. A separate investigation into this matter was made by analyst Dan Dolev. This means that it is impossible to compete in the cost of manufacturing products produced by SpaceX.

Elon Musk has been accused of stoking the flames of a ‘fan army’ that ‘harasses’ women who criticise him online. Freelance writer Erin Biba dubbed the billionaire’s supporters ‘MuskBros’ and described them as ‘mostly young, mostly white, almost entirely men’ who ‘make it their mission to descend on women who criticize Musk, and tear them to pieces’. Shannon Stirone, a freelance journalist who covers space for publications like Popular Science, Wired, and The Atlantic, noted "It is as though they’ve invested their own identity as males into Elon and his work that when anyone (especially women) dares to say anything that isn’t ‘praise for Elon’ it’s only a matter of minutes before the nasty messages come flowing in."

|

NEWSLETTER

|

| Join the GlobalSecurity.org mailing list |

|

|

|